Beyond the Odometer: A Deep Dive into Mileage Rates for Business and Travel

Beyond the Odometer: A Deep Dive into Mileage Rates for Business and Travel

Blog Article

Exploring Mileage Rates: What You Need to Know for Business and Personal Use

Mileage rates are more important than they might seem, impacting both personal and professional financial planning. Whether you're a independent contractor claiming tax deductions or a entrepreneur reimbursing employees, understanding these rates is essential for effective expense management.

### What are Mileage Rates?

Miles Rates are preset amounts that the IRS allows for the expense of operating a vehicle for work-related purposes. These rates are adjusted annually to reflect fluctuations in fuel prices, maintenance costs, and other relevant factors.

### Key Benefits of Mileage Rates

- **Reducing Taxes:** People and companies can deduct mileage expenses from their tax base, notably reducing their tax liability.

- **Paying Back Employees:** Employers can reimburse employees for work-related travel expenses using the standard mileage rate, guaranteeing fair compensation.

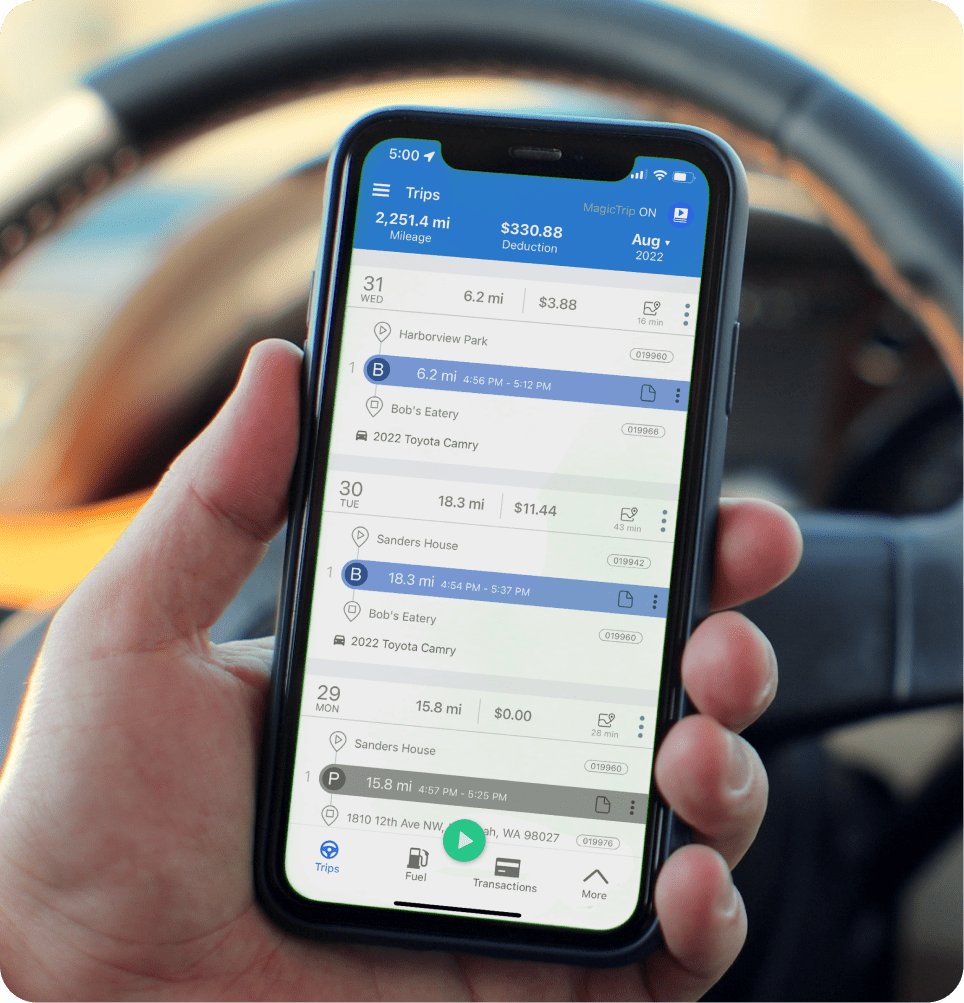

- **Expense Tracking:** Mileage rates provide a uniform method for tracking and reporting transportation costs, streamlining expense management.

- **Budgeting and Forecasting:** By understanding mileage rates, people and companies can better budget for travel expenses and make well-thought-out decisions about travel plans.

### Steps to Apply Mileage Rates

1. **Identify Work-Related Travel:** Accurately track the work-related distance driven for each trip.

2. **Apply the Standard Rate:** Multiply the overall business miles by the current standard mileage rate set by the IRS.

3. **Keep Detailed Logs:** Maintain detailed records of all business trips, including dates, starting and ending points, and the reason of each trip.

4. **Monitor Annual Changes:** The IRS updates the standard mileage rate yearly, so make sure you are using the most current rate for your tax year.

### Alternative Mileage Methods

While the IRS standard Miles Rates is commonly applied, there are alternative methods for calculating mileage expenses:

- **Detailed Cost Tracking:** This method allows you to deduct the real costs associated with operating your vehicle, such as gas, oil, repairs, and insurance. However, it requires detailed record-keeping and may be more challenging to calculate.

- **Flat Rate Per Mile:** Some businesses may set up their own fixed rate per mile for employee reimbursements, which can differ based on factors like vehicle type and local fuel prices.

Understanding mileage rates is vital for anyone who uses a vehicle for work or individual purposes. By accurately tracking mileage and applying the appropriate rates, you can optimize your finances, lower tax liabilities, and guarantee equitable reimbursement for travel expenses.